Identity Theft Surge: Protect Yourself Now!

Anúncios

A recent study indicates a concerning 20% surge in identity theft cases, underscoring the urgent need for individuals to adopt proactive security measures to safeguard their personal and financial information against this escalating threat.

Anúncios

The digital age, while offering unprecedented convenience, has also ushered in a new era of risk, with a recent study revealing a significant New Study Reveals 20% Increase in Identity Theft Cases: Tips to Protect Yourself. This alarming statistic serves as a crucial wake-up call for everyone. Are you adequately protected against this growing threat? Understanding the nuances of identity theft and implementing robust preventative strategies is no longer optional; it’s a necessity in our interconnected world.

Understanding the Alarming Rise in Identity Theft

The recent revelation of a 20% increase in identity theft cases prompts a deeper look into the factors fueling this disturbing trend. While the digital landscape offers unparalleled connectivity, it also presents new vulnerabilities that fraudsters are quick to exploit. Understanding these underlying causes is the first step toward effective prevention, allowing individuals and institutions to fortify their defenses.

Anúncios

What’s Driving the Surge?

Several interconnected factors contribute to the escalating numbers of identity theft. The proliferation of online services, from banking to shopping, means more personal data is being shared digitally than ever before. This expanded digital footprint creates more potential targets for cybercriminals. Moreover, the sophistication of phishing scams and malware has increased dramatically, making it harder for the average user to distinguish legitimate communications from fraudulent ones. The dark web also plays a significant role, serving as a marketplace for stolen personal information, enabling fraudsters to easily acquire data for malicious purposes.

* Increased online presence and digital data sharing.

* More sophisticated cyberattack methods, including phishing and malware.

* The growing market for stolen data on the dark web.

The shift to remote work and increased reliance on personal devices for professional tasks has also inadvertently expanded the attack surface. Many home networks lack the robust security protocols found in corporate environments, making them easier targets for data breaches. This highlights a critical need for individuals to extend office-level security practices to their personal devices and networks. The sheer volume of data breaches reported by various organizations also contributes significantly. Each breach, regardless of scale, potentially exposes thousands or millions of individuals’ data, which can then be compiled and used for identity theft.

The Impact on Individuals and the Economy

The consequences of identity theft extend far beyond the immediate financial losses. Victims often face long and arduous processes to restore their credit, clear their names, and recover stolen funds. This can lead to significant emotional distress, stress, and even long-term psychological impacts. The time and effort required to resolve identity theft cases can be overwhelming, diverting resources and attention from other essential aspects of life.

Economically, the impact is immense. Financial institutions incur substantial losses from fraudulent transactions, which are often passed on to consumers through higher fees or reduced services. Businesses lose consumer trust, leading to decreased patronage and potentially severe reputational damage. Law enforcement agencies are also burdened with the increasing caseloads, requiring more resources to investigate and prosecute these complex crimes. The overall cost to the global economy runs into billions of dollars annually, affecting everything from individual savings to nationwide economic stability. Therefore, addressing identity theft is not just a personal responsibility but a collective societal challenge requiring a multifaceted approach.

Recognizing the Red Flags of Identity Theft

Identifying the early warning signs of identity theft is crucial for mitigating potential damage. Often, victims are unaware that their identity has been compromised until significant fraudulent activity has already occurred. Being vigilant and recognizing these red flags can help you take swift action, minimizing the impact and protecting your financial and personal well-being.

Unusual Account Activity

One of the clearest indicators of identity theft is unexpected activity on your financial accounts. This includes unfamiliar transactions, charges for items you didn’t purchase, or withdrawals you didn’t authorize. Regularly reviewing your bank and credit card statements is paramount. Even small, seemingly insignificant charges should be investigated, as these can sometimes be “test” transactions by fraudsters to see if an account is active before a larger fraudulent spree.

* Unfamiliar transactions on bank or credit card statements.

* Receipt of bills for services or products you didn’t order.

* Notifications from banks or creditors about declined transactions you didn’t attempt.

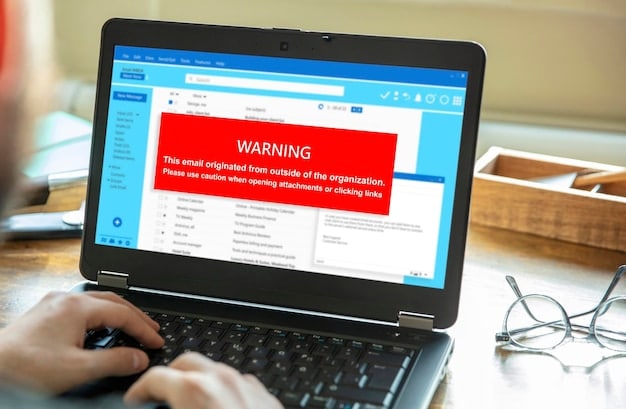

Beyond financial accounts, be wary of unusual login attempts or notifications from online services that you use. If you receive an email or text message about a password reset you didn’t initiate, or a login from an unrecognized device or location, it’s a strong sign that someone might be trying to access your accounts. Always verify such alerts directly with the service provider through official channels, rather than clicking on links within suspicious messages.

Unexpected Communications and Mail

Receiving mail or communications about accounts you never opened, or debt collection notices for unknown debts, are serious red flags. Identity thieves often open new credit lines or apply for loans in your name. If you start getting pre-approved credit offers addressed to you but with slight variations in your name or address, it could indicate that your information is being used, or that someone is attempting to create a synthetic identity using your details.

Furthermore, unexplained calls from debt collectors or sudden drops in your credit score without clear reasons warrant immediate investigation. Many credit monitoring services offer alerts for changes to your credit report, which can be invaluable tools for early detection. If legitimate mail you expect, such as bills or statements, suddenly stops arriving, it could mean that an identity thief has changed your mailing address to intercept your correspondence. This is a common tactic to gain control over your accounts.

Signs of a Compromised Personal Identity

Beyond financial indicators, there are other, more personal signs that your identity might be at risk. If you are denied credit for no apparent reason, or if you receive tax forms (like W-2s) from employers you’ve never worked for, your Social Security number may have been compromised. Similarly, if you notice your existing medical records contain diagnoses or treatments you never received, it could signify medical identity theft, where someone is using your insurance for healthcare services. Staying vigilant about all forms of personal information and promptly investigating any discrepancies is vital.

Robust Strategies: Safeguarding Your Digital Footprint

In an era where our lives are increasingly intertwined with the digital realm, protecting our online presence is paramount to preventing identity theft. A comprehensive approach involves not just reacting to threats but proactively building strong defenses across all digital platforms. This proactive stance ensures that your personal information remains secure, minimizing the risk of exploitation by cybercriminals.

Strengthening Passwords and Multi-Factor Authentication

The foundation of digital security lies in strong, unique passwords. Avoid using easily guessable information like birthdays or common phrases. Instead, opt for complex combinations of uppercase and lowercase letters, numbers, and symbols. The longer your password, the harder it is to crack. Using a password manager can greatly simplify this, allowing you to create and store unique, strong passwords for all your accounts without having to remember them individually.

Beyond passwords, enabling multi-factor authentication (MFA) is a critical layer of defense. MFA requires you to provide two or more verification factors to gain access to an account. This typically involves something you know (your password) and something you have (a code sent to your phone or generated by an authenticator app). Even if a thief manages to steal your password, they would still need access to your second factor to breach your account, making it significantly more difficult for them to succeed.

* Create complex, unique passwords for each account.

* Utilize a reputable password manager.

* Always enable multi-factor authentication (MFA) whenever available.

Regularly updating your passwords is also a good practice, especially for high-value accounts like banking and email. While password managers streamline this process, manually changing critical passwords every few months can add another layer of security. Avoid reusing passwords across multiple sites, as a breach on one site can compromise all accounts sharing that password.

Securing Your Devices and Networks

Your personal devices—laptops, smartphones, and tablets—are gateways to your digital life and must be adequately secured. Ensure your operating system and all software applications are always up to date. Software updates often include critical security patches that fix vulnerabilities attackers could exploit. Installing reputable antivirus and anti-malware software is also essential for detecting and removing malicious threats.

When it comes to networks, always use a secure, private Wi-Fi connection. Public Wi-Fi networks in cafes or airports are often unsecured and can be easily intercepted by malicious actors, allowing them to capture your data. If you must use public Wi-Fi, consider a Virtual Private Network (VPN) to encrypt your internet traffic, providing a secure tunnel for your data. Your home network should also be secured with a strong password, and the default router credentials should always be changed. Periodically check your router’s security settings to ensure optimal protection.

Data Privacy Best Practices

Being mindful of what personal information you share online is crucial. Be cautious about oversharing on social media, as seemingly innocuous details—like your pet’s name or your favorite high school—can be used by fraudsters to answer security questions. Review the privacy settings on all your social media accounts and limit who can view your posts and personal information.

Before sharing your data with any website or application, understand their privacy policy. Opt out of data sharing with third parties whenever possible. When providing sensitive information online, ensure the website uses HTTPS (indicated by a padlock icon in your browser’s address bar), which means the connection is encrypted. Regularly check your credit reports for any discrepancies and consider freezing your credit if you are not actively seeking new lines of credit. This prevents new accounts from being opened in your name without your explicit permission and can be a powerful deterrent against identity thieves.

Protecting Your Personal Information Offline

While much of the focus on identity theft prevention centers on digital security, a significant portion of personal information remains vulnerable in the physical world. Protecting your data offline is just as critical as safeguarding your digital footprint. This involves careful management of physical documents, awareness in public spaces, and cautious disposal of sensitive materials.

Managing Physical Documents and Mail

Your physical mail contains a wealth of personal information that identity thieves can exploit. Be vigilant about incoming mail, especially credit card applications, bank statements, and government correspondence. Collect your mail promptly from your mailbox to prevent theft. If you plan to be away for an extended period, have your mail held at the post office or arrange for a trusted friend or neighbor to collect it.

When it comes to sensitive documents, such as tax returns, medical records, or financial statements, store them securely in a locked file cabinet or a safety deposit box. Avoid carrying your Social Security card in your wallet; memorize the number or keep it in a secure location at home. Regularly review all statements and shred any old documents containing personal details before discarding them. A cross-cut shredder is recommended, as it makes reconstruction of documents much more difficult than a strip-cut shredder.

* Collect mail promptly and consider mail holds when away.

* Store sensitive documents securely in a locked cabinet or safety deposit box.

* Shred all documents containing personal information before disposal using a cross-cut shredder.

Be especially careful with receipts from ATMs, gas pumps, or stores, as these can sometimes contain partial account numbers or other details that could be used in conjunction with other stolen information. If you dispose of old mobile phones or computers, ensure all data is completely wiped or the hard drive is physically destroyed to prevent recovery of sensitive information.

Being Wary in Public and Social Situations

Identity theft can also occur through less sophisticated means, often referred to as “shoulder surfing” or “dumpster diving.” When using ATMs or point-of-sale terminals, be aware of your surroundings and shield your PIN. Be cautious about discussing personal information loudly in public places, as you never know who might be listening. Similarly, do not leave your purse, wallet, or other personal belongings unattended, even for a moment.

“Dumpster diving” involves thieves sifting through discarded trash for personal information. This reinforces the importance of shredding documents before disposal. Even seemingly harmless items, like old utility bills or junk mail with your name and address, can provide data points that help a thief piece together your identity. Be discreet with personal information, whether you are filling out forms in a public place or giving details over the phone. If a call seems suspicious, hang up and call the organization back using a trusted phone number from their official website or bill.

Protecting Your Social Security Number and Other Identifiers

Your Social Security Number (SSN) is the single most valuable piece of information for identity thieves, as it can be used to open new credit accounts, apply for loans, or even secure employment in your name. Refrain from giving out your SSN unless absolutely necessary and for a legitimate purpose, such as for employment, taxes, or a medical provider. Always question why an organization needs your SSN and if there’s an alternative identifier they can use.

Be cautious of organizations that display your SSN on identification cards or other public documents. If you have a choice, opt for an alternative identifier. Many services now allow you to create a unique PIN or other form of identification instead of relying solely on your SSN. These simple, consistent practices offline will significantly reduce your vulnerability to identity attackers, complementing your digital security efforts.

What to Do If Your Identity Is Compromised

Discovering that your identity has been compromised can be deeply unsettling, but swift and strategic action can significantly limit the damage. While the process of recovery can be complex, a systematic approach can guide you through the necessary steps to reclaim your identity and secure your financial future.

Immediate Actions to Take

The moment you suspect identity theft, act quickly. First, contact the companies where the fraud occurred. This includes your bank, credit card companies, and any other financial institutions involved. Report the fraudulent activity immediately, explain that you are a victim of identity theft, and request to close or freeze the affected accounts. Many institutions have dedicated identity theft departments that can guide you through their specific procedures.

Next, place a fraud alert on your credit reports with one of the three major credit bureaus (Equifax, Experian, or TransUnion). Placing an alert with one bureau will automatically notify the other two. A fraud alert requires businesses to verify your identity before issuing new credit, significantly hindering a thief’s ability to open new accounts in your name. You are also entitled to a free credit report from each bureau annually, which you should obtain and review carefully for any suspicious activity.

* Contact affected companies and financial institutions immediately to report fraud.

* Place a fraud alert with one of the three major credit bureaus.

* Review your credit reports from all three bureaus.

It’s also crucial to gather as much evidence as possible. Keep detailed records of all communications, including dates, names of people you spoke with, and summaries of conversations. Document any fraudulent transactions or activities you identify. This information will be vital for filing official reports and for your ongoing recovery efforts. Be wary of any communication from supposed financial institutions asking for personal details; always contact them directly using official numbers.

Filing Reports and Documenting Fraud

After contacting financial institutions and placing fraud alerts, the next critical step is to file an identity theft report with the Federal Trade Commission (FTC) at IdentityTheft.gov. The FTC provides a comprehensive recovery plan and generates an Identity Theft Report, which is a key document that can be used to prove to businesses that you are a victim of identity theft. This report simplifies the process of resolving issues with creditors and removing fraudulent information from your credit report.

Following the FTC report, file a police report with your local law enforcement agency. While local police may not always actively investigate identity theft cases, a police report can be essential for disputing fraudulent transactions, dealing with credit bureaus, and for legal purposes. Bring a copy of your FTC Identity Theft Report and any other supporting documentation when you make your police report. Keep copies of both the FTC and police reports, as you will likely need them to dispute fraudulent accounts and charges.

Long-Term Recovery and Monitoring

Identity theft recovery is often an ongoing process. Continue to monitor your financial statements, credit reports, and any other accounts for unusual activity. Consider signing up for a credit monitoring service that alerts you to changes in your credit report. You may also want to explore identity theft protection services that offer more comprehensive monitoring, remediation assistance, and insurance coverage.

It’s also important to update all your passwords for online accounts, especially for email, banking, and social media. Regularly check your digital footprint to ensure no new fraudulent accounts have been opened under your name. Be patient and persistent; resolving identity theft can take time and effort. However, with consistent vigilance and by following these steps, you can significantly improve your chances of a successful recovery and protect yourself from future incidents. Seeking advice from legal professionals specializing in consumer rights or identity theft if complex issues arise can also be beneficial.

Advanced Protection: Beyond the Basics

While fundamental security measures are crucial, adopting advanced protection strategies can significantly bolster your defense against evolving identity theft threats. Moving beyond the basics involves leveraging sophisticated tools, understanding the nuances of digital privacy, and cultivating a proactive mindset towards personal security. These measures offer an elevated level of protection, making it far more challenging for identity thieves to breach your defenses.

Exploring Identity Theft Protection Services

Dedicated identity theft protection services offer a layer of security that goes beyond what individuals can typically manage on their own. These services often provide comprehensive monitoring: scanning the dark web for your personal information, tracking changes to your credit reports, and monitoring public records for fraudulent use of your identity. They can alert you to suspicious activity, allowing for quick response times.

Furthermore, many services offer restoration assistance. If your identity is compromised, they can guide you through the recovery process, helping you contact creditors, dispute fraudulent charges, and navigate the complex process of restoring your good name. Some even include identity theft insurance, which covers expenses incurred during the recovery process, such as legal fees or lost wages. While these services come with a cost, the peace of mind and expert assistance they provide can be invaluable, especially given the rising rates of identity theft.

* Dark web monitoring for stolen personal data.

* Real-time alerts for suspicious credit or personal information activity.

* Expert assistance and guidance for identity restoration.

Before subscribing to a service, research different providers, compare their features, reviews, and pricing. Ensure they offer the specific protections relevant to your needs and understand their data handling practices. A robust service should offer 24/7 monitoring, prompt alerts, and accessible customer support.

Leveraging Biometric and Hardware Security

Biometric authentication, such as fingerprint or facial recognition, offers a more secure and convenient alternative to traditional passwords for accessing devices and certain applications. While not foolproof, biometrics are significantly harder for thieves to replicate or steal compared to alphanumeric passwords. When available, opting for biometric login methods adds an extra layer of security that’s tied directly to your unique physical characteristics.

Hardware security keys (e.g., YubiKey) are another powerful tool for advanced protection, particularly for critical accounts like email and cloud storage. These physical devices provide a “something you have” factor for multi-factor authentication, making it virtually impossible for someone to access your account without physical possession of the key. Unlike SMS codes, hardware keys are resistant to phishing and SIM-swapping attacks, offering a highly secure authentication method that is difficult for even sophisticated attackers to defeat. Integrating these tools into your security routine, especially for your most sensitive accounts, can dramatically enhance your overall protection.

Educating Yourself and Staying Informed

The landscape of identity theft and cybercrime is constantly evolving, with new threats and tactics emerging regularly. Staying informed about the latest scams, data breaches, and security vulnerabilities is critical for maintaining an effective defense. Subscribe to cybersecurity news outlets, follow reputable identity theft prevention organizations, and attend webinars or workshops on digital security.

Understanding how common scams work, such as phishing emails that mimic legitimate organizations or tech support scams, can help you identify and avoid them. Regular self-education empowers you to make informed decisions about your online behavior and to adopt new security measures as needed. Share this knowledge with family and friends, as a collective awareness strengthens overall community security. A well-informed individual is a difficult target for identity thieves. Continuous learning ensures that your protection strategies remain current and effective against emerging threats.

Legal Recourse and Policy Implications

Addressing the increasing wave of identity theft extends beyond individual actions; it demands a robust legal framework and proactive policy interventions. Understanding your rights as a victim and knowing how governmental and corporate policies are evolving to combat this issue is essential for both prevention and recovery.

Victim’s Rights and Legal Protections

As a victim of identity theft, you are afforded certain rights and protections under the law. The Fair Credit Reporting Act (FCRA) empowers you to dispute inaccurate information on your credit report that results from identity theft. Credit bureaus are legally required to investigate these disputes and remove fraudulent entries. The Fair Credit Billing Act (FCBA) protects you from being held responsible for unauthorized credit card charges, limiting your liability to a nominal amount or entirely, provided you report the fraud promptly.

Additionally, the Identity Theft and Assumption Deterrence Act makes identity theft a federal crime, allowing for prosecution of perpetrators. Many states also have their own identity theft laws, offering further protections and avenues for legal recourse. Consult with legal professionals specializing in identity theft and consumer rights if you face persistent issues or require assistance with complex legal challenges. They can guide you through the process of filing lawsuits against creditors or data breach entities if necessary. These legal provisions are designed to help victims reclaim their financial and personal integrity without undue burden.

* Rights to dispute fraudulent entries on credit reports under FCRA.

* Protection from liability for unauthorized credit card charges via FCBA.

* Federal and state laws criminalizing identity theft and offering victim support.

Victims are also entitled to obtain an Identity Theft Report from the Federal Trade Commission (FTC), which serves as official documentation that your identity has been compromised. This report can be crucial when dealing with financial institutions, creditors, and even law enforcement agencies, streamlining the recovery process by providing a recognized proof of victimization. Knowing these rights empowers you to confidently navigate the recovery process and hold accountable those responsible for the theft of your personal information.

Government and Industry Responses

Governments worldwide are implementing various policies and initiatives to combat identity theft. These include enhanced cybersecurity legislation, stricter data protection regulations (such as GDPR and CCPA), and increased funding for law enforcement agencies specializing in cybercrime. Public awareness campaigns are also being launched to educate citizens on preventative measures and how to report incidents. Collaborative efforts between government bodies and private sector entities are also becoming more common, aiming to share threat intelligence and develop joint strategies to protect critical infrastructure and consumer data.

From an industry perspective, financial institutions, technology companies, and other data-handling organizations are investing heavily in advanced security technologies, such as AI-powered fraud detection systems, biometric authentication, and data encryption. They are also implementing stronger internal protocols for data handling and employee training to minimize the risk of insider threats and human error. However, a balance must be struck between implementing robust security measures and ensuring user convenience. Continual adaptation and innovation are necessary as cybercriminals become more sophisticated, highlighting the need for dynamic, flexible policies that can evolve with the threat landscape.

The ongoing battle against identity theft requires a multi-pronged approach that combines individual vigilance, technological innovation, and strong legal and policy frameworks. By understanding these dimensions, individuals can not only protect themselves more effectively but also advocate for stronger protections in the broader societal context. This holistic understanding reinforces the importance of collective action and shared responsibility in safeguarding personal information in an increasingly digital world.

| Key Point | Brief Description |

|---|---|

| 🛡️ Proactive Prevention | Implement strong passwords, MFA, and safeguard physical documents to minimize risk. |

| 🚨 Recognize Red Flags | Monitor accounts and mail for suspicious activity to detect theft early. |

| ✅ Immediate Response | Act quickly by contacting institutions and filing reports with FTC/police after compromise. |

| 💡 Advanced Measures | Consider identity theft protection services, biometrics, and hardware keys for enhanced security. |

Frequently Asked Questions About Identity Theft

Identity theft most commonly occurs through data breaches exposing personal information, phishing scams tricking individuals into revealing sensitive data, and malware infecting devices to steal credentials. Physical theft of mail or wallets, as well as unsecured public Wi-Fi networks, also play significant roles. Additionally, dumpster diving for discarded documents remains a threat. Vigilance across both digital and physical domains is essential for prevention.

You should check your credit reports at least once a year from each of the three major credit bureaus (Equifax, Experian, TransUnion). However, for enhanced protection, consider utilizing services that offer more frequent monitoring or setting up alerts for significant changes. This proactive approach helps detect fraudulent accounts or activities promptly, allowing for quicker intervention and minimizing potential damage from identity theft.

Yes, freezing your credit is a highly effective way to prevent identity thieves from opening new credit accounts in your name. A credit freeze restricts access to your credit report, meaning lenders cannot view it when assessing a credit application. While it doesn’t prevent all types of identity theft, it significantly limits the damage that can be done. You can temporarily lift the freeze when applying for new credit yourself.

Multi-factor authentication (MFA) adds a crucial layer of security by requiring a second verification step beyond just a password. This might be a code sent to your phone or a biometric scan. Even if a thief obtains your password, they are blocked without access to this second factor. MFA significantly reduces the risk of account compromise, making it much harder for identity thieves to gain unauthorized access to your online accounts.

If your PII is exposed in a data breach, immediately change passwords for all affected accounts and any other accounts using similar credentials. Enable multi-factor authentication wherever possible. Consider placing a fraud alert on your credit report and monitor your financial statements closely for suspicious activity. If the breach is significant, consider freezing your credit to prevent new accounts from being opened in your name without your authorization.

Conclusion

The latest study, highlighting a 20% increase in identity theft cases, undeniably underscores the urgency of robust personal security in our increasingly digital world. While the statistics are concerning, they also serve as a powerful catalyst for individual action and collective vigilance. Protecting your identity is not a passive endeavor; it requires an active, informed, and continuous commitment to safeguarding your personal information, both online and offline. By implementing the strategies discussed—from strengthening digital defenses and recognizing red flags to managing physical documents and understanding legal recourses—individuals can significantly enhance their resilience against this pervasive threat. Staying informed and adapting to evolving risks remain paramount in this ongoing battle, ensuring that you maintain control over your most valuable asset: your identity.