US federal government’s new anti-inflation initiatives: 6-month impact forecast

Anúncios

The federal government has unveiled a comprehensive package of initiatives aimed at curbing escalating inflation, with economists projecting a measurable impact within a six-month timeframe, focusing on supply chain stabilization and fiscal policy adjustments.

Anúncios

The economic landscape in the United States has been a subject of intense scrutiny, largely due to persistent inflationary pressures impacting households and businesses alike. Against this backdrop, the Federal Government Announces New Initiatives to Combat Inflation – Projected Impact in 6 Months, signaling a dedicated effort to stabilize prices and restore economic equilibrium. These measures encompass a multifaceted approach, aiming to tackle the root causes of inflation while mitigating its immediate effects on the everyday lives of Americans.

understanding inflation: a growing challenge for the US economy

Inflation, characterized by the sustained increase in the general price level of goods and services, has emerged as a significant economic hurdle for the United States in recent times. This upward trajectory in prices reduces purchasing power, affecting savings, investments, and the overall financial well-being of citizens. Understanding the nuanced causes behind this phenomenon is critical for devising effective counter-measures.

Anúncios

Several factors have contributed to the recent surge in inflation. Global supply chain disruptions, exacerbated by geopolitical events and pandemic-related lockdowns, have led to shortages and increased production costs. High consumer demand, fueled by fiscal stimulus measures and accumulated savings, has also outstripped supply in many sectors, driving prices upward. Furthermore, rising energy costs and a tight labor market, where wage growth has struggled to keep pace with price increases, have added to the inflationary spiral. The confluence of these elements creates a complex challenge that requires a targeted and comprehensive response from policymakers.

root causes and economic indicators

Pinpointing the exact roots of inflation is crucial for effective policy intervention. Economic indicators like the Consumer Price Index (CPI), Producer Price Index (PPI), and core inflation rates provide valuable insights into price movements across various sectors. Analyzing these metrics helps economists and policymakers distinguish between temporary price fluctuations and more persistent inflationary trends. Supply-side shocks, demand-pull pressures, and cost-push factors are often cited as the primary drivers.

- Supply Chain Bottlenecks: Disruptions in global logistics and production capacity have limited the availability of goods, driving up prices due to scarcity.

- Robust Consumer Demand: Strong post-pandemic recovery and substantial savings have fueled consumer spending, creating demand-side pressure on prices.

- Energy Price Volatility: Fluctuations in oil and gas prices directly impact transportation and manufacturing costs, which are then passed on to consumers.

- Labor Market Tightness: Wage increases, while beneficial for workers, can contribute to higher labor costs for businesses, potentially leading to increased prices.

The Federal Reserve and government agencies closely monitor these indicators to assess the severity and trajectory of inflationary pressures. Their collective goal is to implement policies that can cool down the economy without triggering a recession, a delicate balancing act that requires precise calibration and timely execution. The announced initiatives are a direct response to these ongoing observations and detailed analyses of economic data.

In essence, combating inflation involves addressing both the symptoms and the underlying causes. The government’s new initiatives represent a strategic attempt to intervene across various economic fronts, from stabilizing supply chains to managing fiscal and monetary policies. The projected impact in six months will serve as an initial benchmark for assessing the efficacy of these comprehensive measures.

key strategies unveiled: federal government’s multi-pronged approach

The federal government has unveiled a series of strategic initiatives designed to combat inflation, reflecting a multi-pronged approach that targets various facets of the economy. These strategies aim to stabilize prices, enhance supply chain resilience, and provide relief to consumers and businesses grappling with rising costs. The comprehensive nature of these measures underscores the government’s commitment to addressing the inflationary challenge head-on.

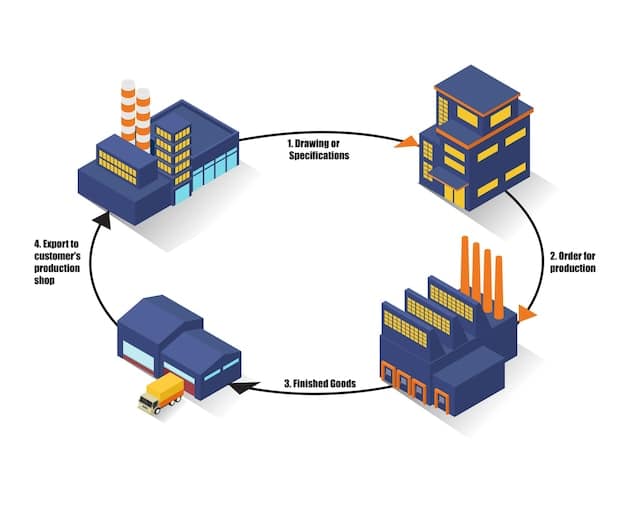

One of the central pillars of the new plan involves direct interventions to ease supply chain disruptions. This includes working closely with ports, freight companies, and manufacturers to reduce backlogs and improve the flow of goods. By streamlining logistics and enhancing infrastructure, the aim is to increase the availability of products, thereby alleviating upward price pressure caused by scarcity. Furthermore, there’s a strong emphasis on fostering domestic production to reduce reliance on volatile international supply chains, creating a more stable and predictable economic environment.

fiscal adjustments and targeted investments

Fiscal policy adjustments play a pivotal role in the government’s anti-inflation strategy. While the specifics are still being ironed out, initial proposals suggest a combination of budget reallocations and targeted investments. The objective is to ensure that government spending is efficient and does not inadvertently contribute to inflationary pressures. This might involve scaling back certain non-essential expenditures while channeling funds into areas that promote long-term economic growth and productivity, such as renewable energy and technological innovation.

- Strategic Budget Reallocation: Shifting funds to essential services and long-term growth projects, reducing spending in areas that might exacerbate demand-pull inflation.

- Incentivizing Domestic Production: Providing tax credits and grants to companies that invest in manufacturing and production facilities within the U.S., thereby strengthening domestic supply.

- Investing in Infrastructure: Modernizing ports, roads, and railways to enhance efficiency in goods transportation, directly addressing supply chain bottlenecks.

- Energy Market Stabilization: Exploring measures to stabilize energy prices, which heavily influence the cost of production and transportation across all sectors.

Beyond fiscal adjustments, the government is also looking into targeted investments that can yield quick and measurable impacts. For instance, initiatives to boost agricultural output and address food supply chain challenges are underway, as food prices are a significant component of household budgets. Similarly, policies aimed at increasing affordable housing supply could help temper rental costs, another major contributor to the current inflationary environment.

The blend of fiscal adjustments and targeted investments reflects a holistic understanding of the economic challenges. These strategies are not merely reactive but are designed to build a more resilient and less inflation-prone economy for the future. The effectiveness of these measures will be closely monitored, with initial assessment expected within the projected six-month timeframe.

projected impact on key economic sectors within 6 months

The efficacy of the federal government’s new anti-inflation initiatives hinges on their ability to translate into tangible positive outcomes across various economic sectors within the next six months. While comprehensive economic rebalancing takes time, certain immediate impacts are anticipated in areas most sensitive to supply chain improvements, fiscal policy adjustments, and consumer behavior shifts. It’s an optimistic but cautiously optimistic outlook.

One of the most directly affected sectors is expected to be manufacturing, particularly those industries heavily reliant on international supply chains. By facilitating smoother logistical operations and encouraging domestic production, the government aims to reduce input costs and increase output. This could lead to a stabilization, or even a slight reduction, in the prices of manufactured goods, benefiting both businesses in their production costs and consumers in their purchasing decisions. Small businesses, often hit hardest by volatile material costs, could also experience significant relief, potentially leading to more stable pricing for their services and products.

consumer goods and energy prices

The impact on consumer goods prices is a primary concern for the average American household. The initiatives are designed to bring down the cost of everyday essentials. If supply chain ameliorations are successful, we could see a moderation in grocery prices and other household staples. Similarly, efforts to stabilize energy markets are expected to reflect in gasoline prices and utility bills, offering some respite from the significant financial burden these costs have imposed.

- Food Prices: Improved agricultural supply and distribution could lead to a deceleration in the rapid increase of food costs, offering relief to household budgets.

- Transportation Costs: Energy market stabilization measures are anticipated to yield lower fuel prices, easing the financial strain on commuters and shipping companies.

- Durables and Electronics: As supply chain bottlenecks clear, the availability of goods like appliances and electronics should improve, potentially leading to more competitive pricing.

- Housing Market: While more complex, initiatives targeting housing supply could, over time, help stabilize rental and purchase prices, though significant immediate changes are less likely.

Another area of projected impact is the overall sentiment of the business community. Reduced uncertainty regarding supply and pricing could encourage greater investment and expansion, fostering economic growth. This positive feedback loop could further contribute to a more stable inflationary environment. However, it’s crucial to acknowledge that external factors, such as global geopolitical events or unexpected economic shocks, could still influence these projections.

The six-month projection represents an initial assessment period. During this time, economists will closely monitor key indicators to determine if the government’s interventions are indeed steering the economy towards a more favorable inflationary trajectory. The collective hope is that these measures will lay the groundwork for long-term price stability and a more resilient economic future.

challenges and potential roadblocks to success

While the federal government’s new anti-inflation initiatives hold promise, their implementation is not without potential challenges and roadblocks. The complex nature of economic systems means that even well-intentioned policies can face unforeseen obstacles, or their impacts might be diluted by external forces. A realistic assessment requires acknowledging these hurdles to ensure the long-term success of the strategies.

One significant challenge lies in the unpredictable nature of global events. Geopolitical tensions, new outbreaks of global health crises, or unexpected natural disasters could easily disrupt fragile supply chains or trigger new rounds of commodity price surges, undermining domestic efforts to control inflation. The interconnectedness of the global economy means that domestic policy cannot fully insulate the nation from external shocks. Furthermore, the sheer scale of the U.S. economy makes it difficult for any single set of policies to have immediate, uniform effects across all sectors and regions.

unforeseen economic shifts and public perception

Economic models, while sophisticated, cannot perfectly predict human behavior or market dynamics. Unforeseen shifts in consumer spending patterns, investor confidence, or technological advancements could either amplify or diminish the intended effects of the government’s initiatives. For example, if consumer demand remains exceptionally high despite attempts to cool it, inflationary pressures could persist longer than anticipated. Public perception and confidence also play a crucial role; if businesses and consumers lack faith in the government’s ability to control inflation, their actions (e.g., hoarding, demanding higher wages) could inadvertently fuel the problem.

- Global Market Volatility: Unpredictable shifts in international energy prices, trade disputes, or supply shortages from other countries can quickly negate domestic progress.

- Lag Effects of Policy: Economic policies often take time to manifest their full effects; the six-month projection might only show initial trends, with substantial changes occurring later.

- Political Divides: Achieving consensus on fiscal and regulatory reforms can be difficult, potentially delaying or weakening the implementation of critical anti-inflation measures.

- Labor Market Dynamics: Persistent labor shortages or significant wage demands could continue to contribute to cost-push inflation, despite other interventions.

Another potential roadblock is the delicate balance between curbing inflation and avoiding a recession. Overly aggressive measures to cool the economy could stifle growth, increase unemployment, and lead to a downturn. The Federal Reserve, working independently but in coordination with the government, must navigate this narrow path carefully. The risk of overshooting or undershooting the policy targets is always present, requiring constant monitoring and potential adjustments.

Ultimately, the success of these initiatives will depend not only on their inherent design but also on the agility and responsiveness of policymakers to emerging challenges. Constant recalibration, transparent communication, and broad public and private sector cooperation will be essential to overcome these potential roadblocks and achieve the desired economic stability.

expert opinions and independent forecasts

As the federal government rolls out its new anti-inflation initiatives, a chorus of expert opinions and independent forecasts has emerged, offering diverse perspectives on the likely outcomes. Economic analysts, think tanks, and financial institutions are weighing in, scrutinizing the proposed measures and providing their projections on the potential impact within the six-month timeframe. These insights are crucial for a comprehensive understanding of the situation, often highlighting nuances that may not be immediately apparent.

Many economists generally commend the multi-pronged approach, recognizing the necessity of addressing both demand-side and supply-side factors of inflation. There is a general consensus that measures aimed at untangling supply chain knots and stimulating domestic production are steps in the right direction. Some predict a gradual deceleration of inflationary pressures, especially in sectors directly benefiting from improved logistics and increased national output. However, the degree of optimism varies significantly among experts, reflecting different assumptions about future global events and domestic economic resilience.

varying degrees of optimism and caution

Some independent forecasts suggest a tangible reduction in the annual inflation rate, possibly nearing the Federal Reserve’s target range, if the initiatives are effectively implemented and no major external shocks occur. These optimistic views often point to the inherent strength of the U.S. economy and its capacity for recovery. They believe that with coordinated fiscal and monetary policies, inflationary expectations can be anchored, leading to more stable prices.

- Supply Chain Improvement: Many experts agree that focused efforts on ports and logistics will yield positive results, gradually easing price pressures on goods.

- Fiscal Prudence: Analysts generally welcome any move towards more targeted and efficient government spending, viewing it as essential for long-term fiscal health.

- Consumer Behavior: Some forecasts rely on the assumption that rising interest rates and moderated demand will contribute significantly to cooling the economy.

- Global Factors: A key variable in most models is the evolution of global energy prices and geopolitical stability, which can significantly alter domestic outcomes.

Conversely, more cautious analysts emphasize the persistence of certain inflationary drivers, such as wage growth struggling to keep pace with past price increases, which could lead to further demands. They also highlight the potential for new supply shocks from unforeseen global developments. These experts typically project a slower, more modest decline in inflation, recognizing the deep-seated nature of some of the current economic challenges. They also caution against declaring victory too soon, underscoring the need for sustained policy vigilance beyond the initial six-month period.

The divergence in expert opinions underscores the complexity of economic forecasting. While there’s a shared understanding of the challenges, the variables at play make precise predictions difficult. The next six months will therefore serve as a critical period to observe which of these forecasts aligns most closely with real-world economic outcomes, providing valuable data for future policy adjustments.

monitoring progress: key metrics and assessment benchmarks

To accurately gauge the effectiveness of the federal government’s new anti-inflation initiatives, robust monitoring mechanisms and clearly defined assessment benchmarks are crucial. The success of these policies will not be determined by anecdotal evidence but by measurable improvements across a range of economic indicators. The six-month projection period will serve as an initial checkpoint, allowing policymakers to assess progress and make necessary adjustments.

The primary metric for measuring success will undoubtedly be the Consumer Price Index (CPI), specifically its year-over-year percentage change. A sustained downward trend in the CPI, particularly core CPI (which excludes volatile food and energy prices), would signal that the anti-inflationary measures are having the desired effect. Beyond the headline CPI, economists will closely scrutinize sub-components to identify where the price moderation is occurring, whether it’s in goods, services, or specific sectors like housing and transportation. This granular data provides a more nuanced understanding of the policy impact.

inflation tracking and economic indicators

Several other key economic indicators will be diligently tracked to provide a holistic view of the economy’s response. These include the Producer Price Index (PPI), which reflects inflation at the wholesale level and often acts as a leading indicator for consumer prices. Wage growth data, employment figures, and consumer spending patterns will also be crucial in understanding whether the economy is cooling down without risking a recession. Energy prices, given their significant impact on overall costs, will be under constant surveillance.

- Consumer Price Index (CPI): The primary indicator for tracking changes in the prices of goods and services purchased by consumers.

- Producer Price Index (PPI): Measures the average change over time in the selling prices received by domestic producers for their output, often foreshadowing CPI trends.

- Wage Growth: Monitoring wage increases versus productivity gains to understand their contribution to inflation and real purchasing power.

- Supply Chain Resilience Metrics: Indicators like shipping costs, port congestion, and inventory levels will be observed for signs of improvement.

- Energy Market Stability: Tracking crude oil prices, gasoline prices, and natural gas costs due to their broad impact on the economy.

In addition to these quantitative metrics, qualitative assessments such as business confidence surveys and consumer sentiment indices will offer insights into market expectations and psychological factors influencing inflation. If businesses anticipate lower costs and consumers expect stable prices, this can contribute to anchoring inflationary expectations, a vital component in controlling price spirals. The government also plans to publish regular reports detailing the progress of its initiatives, ensuring transparency and accountability.

The next six months will be a critical test period, during which these benchmarks will provide the necessary data to determine if the initiatives are on track to achieve their objectives. Continuous monitoring and a willingness to adapt policies based on incoming data will be paramount to successfully combatting persistent inflation and fostering long-term economic stability.

looking beyond 6 months: long-term vision for economic stability

While the immediate focus of the federal government’s anti-inflation initiatives is on measurable impact within six months, a broader, long-term vision for economic stability is equally critical. Combating inflation successfully requires not just short-term fixes but structural reforms and sustained policy commitments that build resilience against future price shocks and foster sustainable growth. This long-term perspective addresses the root causes of economic volatility and aims to create an environment where inflation remains manageable.

A key component of this long-term vision involves bolstering domestic manufacturing and supply chain resilience. Reducing dependence on single points of failure in global supply networks, diversifying sourcing, and investing in advanced manufacturing technologies within the U.S. will create a more stable supply of goods. This strategic shift aims to minimize the impact of external disruptions on domestic prices and ensure that industries can ramp up production quickly in response to demand fluctuations.

structural reforms and sustainable growth

Beyond supply chains, the long-term vision encompasses broader structural reforms. These include investments in human capital through education and workforce training programs to address labor market imbalances and enhance productivity. Policies aimed at fostering competition across various industries can also prevent price gouging and promote efficiency. Furthermore, continued emphasis on fiscal responsibility, managing national debt, and ensuring the sustainability of government spending are vital for maintaining low and stable inflation over decades.

- Domestic Production Enhancement: Sustained investment in U.S. manufacturing capabilities, including reshoring and attracting new industries.

- Workforce Development: Programs focused on upskilling and reskilling the labor force to address skill gaps and increase productivity.

- Competition Policy: Enforcing antitrust laws and promoting fair competition to prevent monopolies and ensure competitive pricing.

- Energy Independence: Investments in renewable energy and diverse energy sources to reduce exposure to volatile fossil fuel markets.

- Fiscal Discipline: Long-term budgetary planning to ensure that government spending is sustainable and does not lead to inflationary pressures.

Another crucial element is the transition to a greener economy. Investing in renewable energy sources not only addresses climate change but also reduces reliance on volatile fossil fuel markets, which have historically been a significant driver of inflationary spikes. Policies supporting innovation and technological advancement across all sectors can enhance productivity and efficiency, a fundamental long-term antidote to inflationary pressures.

The journey towards economic stability is continuous, requiring vigilance and adaptability. The initiatives announced by the federal government are a significant step, but their true success will be measured by their ability to pave the way for a more resilient, equitable, and inflation-resistant economy for generations to come. This ongoing commitment to strategic planning and responsive policy will define the nation’s economic future.

| Key Initiatives | Projected Impact |

|---|---|

| 🚢 Supply Chain Reforms | Reduced bottlenecks, increased goods availability, potentially easing prices on consumer products. |

| 💰 Fiscal Adjustments | More targeted government spending, aiming to avoid demand-pull inflation and promote stability. |

| 💡 Domestic Production Boost | Reduced reliance on imports, fostering price stability and resilience against external shocks. |

| 📊 Economic Monitoring | Continuous tracking of CPI, manufacturing, and employment data to assess and adjust policies. |

frequently asked questions about inflation initiatives

The primary goals are to stabilize prices, reduce the burden of rising costs on households and businesses, and foster long-term economic stability. The initiatives aim to address both supply-side disruptions and manage aggregate demand to bring inflation under control and mitigate its negative impacts across the economy.

The federal government projects a measurable impact within a six-month timeframe. While some effects, like improved supply chain flow, might be observed sooner, a significant shift in overall inflation rates is typically gradual and depends on the sustained implementation of the strategies and external economic factors.

The initiatives are designed to address key drivers of current inflation, including supply chain bottlenecks and certain demand-side pressures. However, global events, such as geopolitical conflicts or new commodity market disruptions, can still impact prices, making absolute control challenging, but aiming for robust mitigation.

Consumer behavior significantly influences inflation. Stable spending patterns, avoiding panic buying, and adapting to economic shifts can help moderate demand-side pressures. Trust in government policies and avoiding inflationary expectations can also contribute to the overall success of anti-inflation efforts by anchoring prices.

Any large-scale economic intervention carries risks. Overly aggressive measures could potentially slow economic growth too much or increase unemployment. Policymakers face the delicate task of cooling inflation without triggering a recession, requiring continuous monitoring and careful adjustments to the initiatives as the economic landscape evolves.

conclusion

The federal government’s announcement of new initiatives to combat inflation marks a pivotal moment in the ongoing efforts to stabilize the U.S. economy. These measures, encompassing supply chain improvements, fiscal adjustments, and investments in domestic production, reflect a comprehensive strategy to tackle the multifaceted challenges of rising prices. While the projected impact within six months offers a tangible timeframe for initial assessment, the ultimate success of these policies hinges on their sustained implementation, adaptability to unforeseen economic shifts, and a collective commitment to long-term economic stability. The coming months will be critical in determining the efficacy of these strategic interventions and their capacity to lay the groundwork for a more resilient and less inflation-prone future for the nation.