US Gas Prices Surge: Experts Forecast $4.25 Avg.

Anúncios

Experts forecast a nationwide increase in gas prices, with predictions indicating an average of $4.25 per gallon, signaling significant impacts on American households and the economy as geopolitical events and supply-demand dynamics continue to push fuel costs upwards, requiring consumers to adapt to higher transportation expenses.

Anúncios

The specter of rising fuel costs perennially haunts American households, and recent forecasts suggest a substantial nationwide increase in gas prices is on the horizon. Experts are predicting an average of $4.25 per gallon, a figure that, if realized, would exert considerable pressure on consumer budgets and potentially slow economic growth. This projected surge isn’t merely a statistical anomaly; it stems from a complex interplay of factors, from geopolitical tensions and supply chain disruptions to domestic policy shifts and seasonal demand fluctuations. Understanding the intricate dynamics at play is crucial for both individual consumers and policymakers alike.

Understanding the Price Surge: Core Drivers

This anticipated hike in gas prices is not an isolated event but rather the culmination of several interconnected global and domestic factors. From the intricacies of crude oil production to the final pump price, each stage adds its layer of complexity and potential volatility.

Anúncios

The primary driver, as always, is the price of crude oil. Global supply and demand dynamics, heavily influenced by OPEC+ decisions and geopolitical stability in oil-producing regions, dictate this foundational cost. When supply is constrained, either intentionally or due to disruptions, prices naturally climb. Coupled with this, refining capacity, which converts crude into usable gasoline, plays a critical role. Bottlenecks or operational issues at refineries can limit the output of gasoline, leading to scarcity and higher prices. Furthermore, the blend of gasoline required varies by season and region, adding another layer of manufacturing complexity and cost.

Global Oil Production and Geopolitical Tensions

Global oil production remains a delicate balance between output from major producers like Saudi Arabia, Russia, and the United States. Decisions by the Organization of the Petroleum Exporting Countries and its allies (OPEC+) to adjust production quotas can send ripples across the market. For instance, if OPEC+ opts for production cuts, the reduced supply against consistent or growing demand inevitably pushes crude prices higher. This strategic control over supply is a core element in managing global oil markets and, by extension, gasoline prices.

Beyond economic decisions, geopolitical events cast a long shadow over oil markets. Conflicts in the Middle East, political instability in major oil-producing nations, or even threats of disruption to key shipping lanes like the Strait of Hormuz, can instantly trigger speculative buying and drive up crude oil futures. The inherent unpredictability of these events often leads to a “risk premium” being built into oil prices, meaning consumers pay more not just for the oil itself, but for the perceived risk of future supply shortages. This premium can significantly inflate gas prices, even without an immediate physical shortage.

- OPEC+ production decisions significantly impact global supply.

- Geopolitical instability creates a “risk premium” in oil prices.

- Supply chain disruptions, like pipeline issues, can cause regional shortages.

- Increased demand from recovering economies drives up crude oil prices.

Refining Capacity and Seasonal Blends

Even if crude oil is abundant, gasoline prices can climb if there isn’t enough refining capacity to process it into usable fuel. Refineries are complex facilities that require significant investment and maintenance. Unexpected shutdowns due to maintenance, natural disasters, or technical failures can temporarily reduce the national supply of gasoline, leading to localized or even widespread price spikes. Furthermore, the type of gasoline produced varies throughout the year. Summer blends, designed to reduce emissions in warmer weather, are more expensive to produce than winter blends. This seasonal transition often contributes to price increases in the spring as refineries switch their production processes. The environmental regulations governing fuel composition also play a part, as stricter standards can necessitate more complex and costly refining processes.

The U.S. has seen a slight decline in overall refining capacity over the past decade, making the system more vulnerable to individual plant outages. When a major refinery goes offline, even temporarily, the ripple effect on regional supply can be immediate and severe, pushing prices at the pump higher. This delicate balance between crude availability and refining output is a constant challenge for the industry.

The combination of limited global supply, regional disruptions, and the specialized nature of refining for specific gasoline blends means that even small shifts in any of these areas can have a magnified effect on prices at the pump. This complexity underscores why gasoline prices are so volatile and often seem to defy simple explanations.

Economic Ripple Effects: Beyond the Pump

The projected increase in gas prices to an average of $4.25 per gallon isn’t just an inconvenience for drivers; it represents a significant economic shockwave that reverberates throughout the entire economy. From the individual consumer’s wallet to the operations of large businesses, the impact is widespread and multifaceted. Higher fuel costs have a direct effect on disposable income, influencing spending patterns and potentially slowing economic growth.

Impact on Consumer Spending and Inflation

For the average American household, rising gas prices mean less money available for other goods and services. Transportation is a non-negotiable expense for many, particularly those commuting to work or fulfilling daily necessities. As a larger portion of their budget is allocated to fuel, consumers are forced to cut back on discretionary spending, impacting sectors like retail, hospitality, and entertainment. This reduction in overall consumer demand can lead to slower economic activity and potentially dampen job growth.

Furthermore, increased fuel costs directly contribute to inflation. Nearly all goods are transported at some point in their journey from production to consumer. When the cost of transportation rises, businesses face higher operational expenses, which they often pass on to consumers in the form of higher prices for everything from food to electronics. This “cost-push” inflation can erode purchasing power, making everyday essentials more expensive and further straining household budgets. The cumulative effect can be a decline in living standards and increased financial stress for many. Wages, in many cases, do not keep pace with these rising costs, leading to a real-term decrease in income.

Business Operations and Supply Chains

Businesses across all sectors are particularly vulnerable to fluctuating fuel prices. For trucking companies, airlines, and courier services, fuel is a primary operational expense. A significant jump in gas prices can decimate profit margins, forcing these companies to either absorb the costs—which small businesses often cannot do—or implement surcharges, which then inflate prices for the end consumer. This creates a chain reaction throughout the supply chain.

For example, a farmer faces higher costs to transport produce to market, a manufacturer pays more to ship raw materials to their factory, and a retailer incurs greater expenses to stock their shelves. Each step adds to the final price of the product. This can lead to increased operational costs, reduced competitiveness for businesses, and in some cases, a decision to delay investments or expansion plans. Industries that rely heavily on transportation, such as logistics, construction, and agriculture, are particularly hit hard. The ripple effect can also lead to delays in deliveries, as companies try to optimize routes or wait for more favorable fuel prices, leading to wider supply chain disruptions and potentially reduced availability of goods.

This widespread impact underscores that gas prices are not just a matter for drivers, but a fundamental metric affecting the economic health of the nation, from the smallest local business to the largest multinational corporation. Any sustained increase demands a strategic approach to mitigate its broader economic consequences.

Government Response and Policy Tools

In anticipation of or response to significant increases in gas prices, governments often face immense public pressure to act. Their responses can range from short-term interventions designed to alleviate immediate financial burdens to longer-term strategies aimed at energy independence and market stability. Each policy tool comes with its own set of potential benefits and drawbacks, and the effectiveness often depends on the underlying causes of the price surge.

Strategic Petroleum Reserve and Tax Holidays

One of the most immediate tools at the government’s disposal is the release of oil from the Strategic Petroleum Reserve (SPR). The SPR is the world’s largest emergency supply, intended to reduce the impact of supply disruptions. Releasing oil from the SPR can temporarily increase the supply of crude oil in the market, which may consequently lower prices. However, this is a short-term solution and its effectiveness is debated. Critics argue that it’s a political maneuver that has minimal long-term impact on global oil prices and can deplete a critical emergency asset. Its use is generally reserved for significant supply crises rather than market fluctuations, as overuse could diminish its strategic value.

Another common proposal during periods of high gas prices is a federal or state gas tax holiday. Suspending or reducing the gasoline tax, which can amount to a significant portion of the pump price, would theoretically lower prices for consumers. While this offers immediate relief, it comes at a cost: reduced revenue for infrastructure projects that depend on these taxes, such as road and bridge maintenance. Moreover, there’s no guarantee that the savings from the tax cut would be fully passed on to the consumer, as retailers might absorb some of the difference. The benefit to the consumer might be negligible compared to the lost government revenue, and the impact tends to be fleeting.

Investment in Renewable Energy and Infrastructure

For a more sustainable and long-term solution to volatile fossil fuel prices, many advocate for increased government investment in renewable energy sources and improved energy infrastructure. Diversifying the national energy mix away from a heavy reliance on oil, through solar, wind, geothermal, and other clean energy technologies, can reduce exposure to global oil market fluctuations. Such investments not only promote energy independence but also contribute to environmental sustainability.

Improved energy infrastructure includes upgrading power grids to handle more renewable energy and building out charging networks for electric vehicles (EVs). Government incentives for EV purchases and the development of robust public transportation systems can also lead to a decrease in gasoline consumption over time. While these investments require significant upfront capital, they promise long-term benefits in terms of energy security, economic stability, and environmental health. However, these are not immediate fixes and their impact on gas prices would only be seen over many years. The shift away from fossil fuels is a multi-decade endeavor, but one that many experts believe is essential for future economic resilience. This long-term vision aims to address the root causes of fuel price volatility by reducing national dependence on a single, globally traded commodity.

Consumer Strategies: Adapting to Higher Costs

While large-scale economic and government policies unfold, individual consumers are left to navigate the immediate financial burden of higher gas prices. Fortunately, there are several practical strategies that can help mitigate the impact of the projected $4.25 per gallon average. These strategies involve a mix of behavioral changes, smart planning, and leveraging available resources to stretch every dollar.

Fuel Efficiency and Driving Habits

One of the most direct ways consumers can counteract rising gas prices is by adopting more fuel-efficient driving habits and ensuring their vehicles are in optimal condition. Simple adjustments to how one drives can lead to significant savings over time. Aggressive driving, characterized by rapid acceleration, hard braking, and speeding, consumes considerably more fuel than smooth, steady driving. Maintaining a consistent speed, especially on highways, and anticipating traffic flows can reduce unnecessary fuel consumption. Using cruise control on open roads helps maintain an optimal speed, further enhancing efficiency.

Additionally, regular vehicle maintenance plays a crucial role. Ensuring tires are properly inflated can improve fuel economy by up to 3% to 4%. A well-tuned engine, clean air filters, and regular oil changes ensure the car runs efficiently, avoiding wasted fuel. Removing unnecessary weight from the vehicle and avoiding carrying items on the roof (like luggage racks when not in use) can also reduce aerodynamic drag and improve mileage. Planning errands to combine multiple trips into one can also minimize cold-start fuel consumption, where engines are least efficient. These seemingly small changes accumulate over time, offering tangible financial relief.

- Drive smoothly: avoid rapid acceleration and hard braking.

- Maintain optimal tire pressure for better mileage.

- Ensure regular vehicle maintenance, including oil changes and air filter checks.

- Remove unnecessary weight from your vehicle.

Alternative Transportation and Budgeting

Beyond optimizing personal vehicle use, exploring alternative transportation options is a powerful strategy to reduce reliance on gasoline. For many, this might mean a greater embrace of public transportation where available. Buses, trains, and subways offer a cost-effective way to commute, often at a fraction of the cost of driving, parking, and fueling a personal vehicle. Carpooling with colleagues or friends is another excellent option, splitting fuel costs and reducing the number of vehicles on the road. The rise of ride-sharing services, while not always cheaper than driving, can be an option for occasional trips, avoiding the fixed costs of vehicle ownership.

For shorter distances, walking or cycling not only saves money on gas but also offers health benefits. Many cities are increasingly investing in pedestrian and cycling infrastructure, making these options more viable. Lastly, for those with the flexibility, working from home even a few days a week can drastically cut down on commuting costs. Budgeting is also key: allocating a specific amount for fuel each month and tracking actual spending can help identify areas for adjustment. Creating a detailed household budget that accounts for higher fuel expenses allows for better financial planning and helps avoid unexpected financial strain. These adaptive measures can empower consumers to navigate the challenges posed by escalating fuel prices.

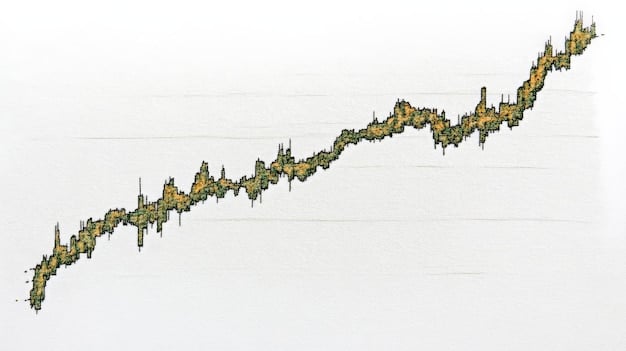

Historical Context: Gas Prices Over Time

Understanding the current predictions of $4.25 per gallon requires looking back at the historical trajectory of gas prices in the United States. Fuel costs have never been static, moving through cycles of highs and lows driven by a myriad of factors. Examining these patterns provides valuable context for the present situation and highlights the complex interplay of global events and domestic policies.

Major Milestones and Volatility

Gasoline prices have experienced several periods of significant volatility throughout history. The 1970s marked a pivotal era with the Arab oil embargoes, which sent prices soaring and led to nationwide gas shortages, fundamentally altering American energy policy and consumer habits. Subsequent decades saw fluctuations tied to geopolitical events, such as the Gulf War in the early 1990s, and economic booms or busts that influenced global demand.

The early 2000s witnessed a steady climb, culminating in record high prices around 2008, largely due to strong global demand, particularly from emerging economies, and some supply concerns. The Great Recession then triggered a sharp decline, but prices rebounded as economies recovered. More recently, the COVID-19 pandemic caused an unprecedented drop in demand and prices in 2020, followed by a sharp recovery as economic activity resumed and supply struggled to keep pace. Each of these periods underscores how sensitive gas prices are to both major global events and day-to-day market forces, often reacting swiftly to political instability or economic shifts. This inherent volatility makes long-term predictions challenging but highlights the need for adaptability.

Factors Influencing Long-Term Trends

While short-term spikes are often tied to immediate events, several underlying factors contribute to the long-term trends in gas prices. Global crude oil production and reserves are paramount; as easily accessible oil becomes scarcer, exploration and extraction become more costly, driving up baseline prices. Technological advancements in drilling, such as fracking, have temporarily increased supply, but the long-term sustainability of these methods and their environmental impact are subjects of ongoing debate.

Demand-side factors also play a critical role, particularly the growth of economies like China and India, which significantly increase global oil consumption. Environmental regulations, both in terms of vehicle emissions and refinery standards, add to the cost of gasoline production, as cleaner fuels often require more complex and expensive processes. Inflation, which gradually erodes the purchasing power of money, means that even if nominal prices stay the same, the real cost of gas might differ. Lastly, the move towards electric vehicles and renewable energy sources, while still nascent in its impact on overall oil demand, represents a significant long-term shift that could eventually stabilize or even reduce reliance on gasoline, fundamentally altering market dynamics over decades. The interplay of these forces ensures that understanding gas prices requires a comprehensive, multi-faceted perspective.

Future Outlook: Navigating Uncertainty

Forecasting future gas prices is inherently challenging, given the multitude of unpredictable variables at play. However, by analyzing current trends, expert opinions, and potential disruptions, we can gain a clearer picture of what the future might hold and how various scenarios could unfold. The anticipated $4.25 per gallon average is a significant marker, but the journey beyond that point remains uncertain, influenced by both global stability and technological evolution.

Expert Predictions and Market Volatility

Experts typically base their predictions on a range of models that incorporate geopolitical forecasts, economic growth projections, OPEC+ production targets, and global inventory levels. The $4.25 per gallon average suggests a consensus among analysts that current bullish market conditions—driven by factors like strong post-pandemic demand, geopolitical risk, and potentially constrained supply—are likely to persist or even intensify. However, it’s crucial to acknowledge the inherent volatility of oil markets. A sudden geopolitical de-escalation, a significant increase in production from a major non-OPEC+ producer (like the US shale industry), or an unexpected economic downturn leading to reduced demand could all send prices reversing course.

Conversely, an escalation of existing conflicts, new supply disruptions, or a stronger-than-expected global economic recovery could push prices even higher. The market is also highly sensitive to speculation, with traders reacting to every scrap of news, sometimes exacerbating price swings beyond what fundamental supply and demand would dictate. Therefore, while a $4.25 average is predicted, consumers should brace for continued fluctuations and recognize that “average” doesn’t mean “stable.” Monitoring reliable energy news sources and understanding the daily drivers of market sentiment becomes increasingly important in such an environment.

Long-Term Trends and Energy Transition

Looking further into the future, the global energy transition presents both challenges and opportunities for gas prices. The accelerating shift towards electric vehicles (EVs) and renewable energy sources like solar and wind power promises a gradual reduction in global demand for fossil fuels. As EV adoption rates climb, particularly in major automotive markets, the overall need for gasoline will eventually decline, putting downward pressure on prices in the very long term. Government policies, such as emissions standards and incentives for clean energy, will further accelerate this transition.

However, this transition is not instantaneous. The sheer scale of the global vehicle fleet and energy infrastructure means that oil will remain a critical energy source for decades to come. During this transition, we might see continued volatility, as investment in new oil production may wane while demand remains robust, creating potential supply gaps. Furthermore, geopolitical events can still disproportionately impact the remaining oil supply. The crucial question for the long term is the pace of this energy transition and whether supply will adapt smoothly to declining demand, or if structural imbalances will lead to continued price swings. Ultimately, the move towards a more diversified and sustainable energy future is seen as the most robust long-term solution to mitigate petroleum price volatility.

| Key Point | Brief Description |

|---|---|

| ⛽ Predicted Average Price | Experts forecast a national average of $4.25 per gallon. |

| 🌍 Core Drivers | Global crude oil prices, geopolitical tensions, and refining capacity issues. |

| 💰 Economic Impact | Higher consumer spending on fuel, increased inflation, and elevated business operational costs. |

| 💡 Consumer Strategies | Fuel-efficient driving, alternative transportation, and smart budgeting. |

Frequently Asked Questions

The current surge in gas prices is primarily driven by a combination of global factors, including geopolitical tensions affecting oil-producing regions, decisions by OPEC+ regarding crude oil production levels, and a rebound in global demand as economies recover. Additionally, domestic refining capacity limitations and the seasonal transition to more expensive summer blend fuels contribute to the increases.

An average of $4.25 per gallon will significantly impact American households by increasing transportation costs and reducing disposable income. This can lead to cuts in discretionary spending and contributes to broader inflationary pressures, as businesses pass on higher fuel costs through increased prices for goods and services. It places additional financial strain on family budgets.

Consumers can adopt several strategies to cope with higher gas prices. These include practicing fuel-efficient driving habits like smooth acceleration and maintaining proper tire pressure, exploring alternative transportation such as public transit or carpooling, and considering remote work options. Additionally, meticulous budgeting and trip planning can help minimize fuel consumption and better manage expenses.

Government interventions like releasing oil from the Strategic Petroleum Reserve or implementing gas tax holidays can offer short-term relief, but their long-term effectiveness in controlling gas prices is often debated. They typically address symptoms rather than root causes. Sustainable solutions often involve long-term investments in renewable energy and improved infrastructure to reduce reliance on fossil fuels.

The long-term outlook for gas prices is complex, influenced by the global energy transition. While continued market volatility is expected, the increasing adoption of electric vehicles and growth in renewable energy sources are anticipated to gradually reduce global demand for gasoline over decades. This shift aims to stabilize prices by diversifying energy sources and reducing reliance on a single commodity.

Conclusion

The projected nationwide increase in gas prices to an average of $4.25 per gallon signals a challenging period for American consumers and businesses alike. This forecast is deeply rooted in the intricate dance between global crude oil supply, geopolitical stability, refining capacity, and domestic demand. While the immediate impact will be felt directly at the pump and in household budgets, the ripple effects extend throughout the economy, contributing to inflationary pressures and influencing business operations. Understanding these complex dynamics is the first step toward navigating this shift. As both government and industry grapple with long-term energy strategies, consumers can empower themselves through mindful driving habits, exploring alternative transportation, and meticulous budgeting. The path ahead promises continued, but adapting to these evolving conditions will be key.